Unlocking the Potential: An analysis of ESG Reporting Maturity in North America

Tuesday, Apr 16, 2024ESG reporting evaluates a company's environmental, social, and governance impact, providing stakeholders with insights into its sustainability practices. It serves as a crucial tool for gauging corporate responsibility, enhancing transparency, and managing reputational risk. Increasingly, investors, customers, and regulators are demanding meaningful ESG disclosures, acknowledging the link between sustainable practices and long-term value creation.

As sustainability takes center stage in the global business landscape, Environmental, Social, and Governance (ESG) reporting has become a critical measure of corporate responsibility and long-term value creation. This comprehensive analysis aims to assess the maturity level of North American businesses in ESG reporting and uncover the factors contributing to their lag behind Europe and Asia.

Overview of ESG Reporting Maturity in Europe & Asia

Europe emerges as a frontrunner in ESG reporting, with robust regulatory frameworks, active investor pressure, and ingrained cultural values supporting its progress. The European Union's sustainable finance initiatives, such as the EU Sustainable Finance Taxonomy and the Non-Financial Reporting Directive, have propelled ESG reporting and integration. European businesses embrace sustainable practices as a core part of their corporate strategies, reinforced by societal expectations and the push for a low-carbon economy.

Asia has witnessed significant advancements in ESG reporting, driven by a combination of factors including government initiatives, investor expectations, and heightened societal awareness. Countries like Japan, South Korea, and Singapore have established ESG reporting guidelines and sustainability frameworks, encouraging companies to disclose comprehensive ESG information. Investors in the region increasingly recognize the value of responsible investing, creating an environment conducive to ESG reporting.

Analysis of North American ESG Reporting Maturity

Analyzing the current state of ESG reporting in North America reveals a diverse landscape, shaped by industries and company sizes. While some North American companies lead in ESG reporting, others lag behind. Concrete statistics, case studies, and examples shed light on the progress made as well as the existing challenges and barriers. Factors such as fragmented regulatory approaches, inconsistent investor expectations, and a broader corporate culture not yet fully embracing sustainability contribute to the varying maturity levels.

Exploring the reasons behind North America's lag in ESG reporting highlights several factors that hinder progress. Regulatory factors play a significant role, with a lack of standardized ESG reporting requirements at the federal level creating uncertainty for businesses. Inconsistent investor attitudes towards ESG integration and reporting, as well as a corporate culture that traditionally prioritizes short-term financial gains, further contribute to the gap.

To bridge the gap in ESG reporting, businesses can implement several strategies:

- Improved collaboration and harmonization among regulatory bodies can establish consistent ESG reporting standards, providing clarity for companies and enabling comparability.

- Education and awareness initiatives can drive investor demand for ESG information, encouraging businesses to enhance their reporting practices.

- Companies should also embed sustainability into their core strategies to overcome cultural barriers and align corporate values with long-term sustainable goals.

While North American businesses may lag behind Europe and Asia in ESG reporting maturity, the potential for improvement remains significant. Adapting to evolving stakeholder expectations and embracing sustainable practices will strengthen competitiveness and ensure long-term viability.

By embracing standardized reporting frameworks, fostering investor trust, and cultivating a culture of responsible business practices, organizations can better prepare for upcoming regulatory and compliance mandates.

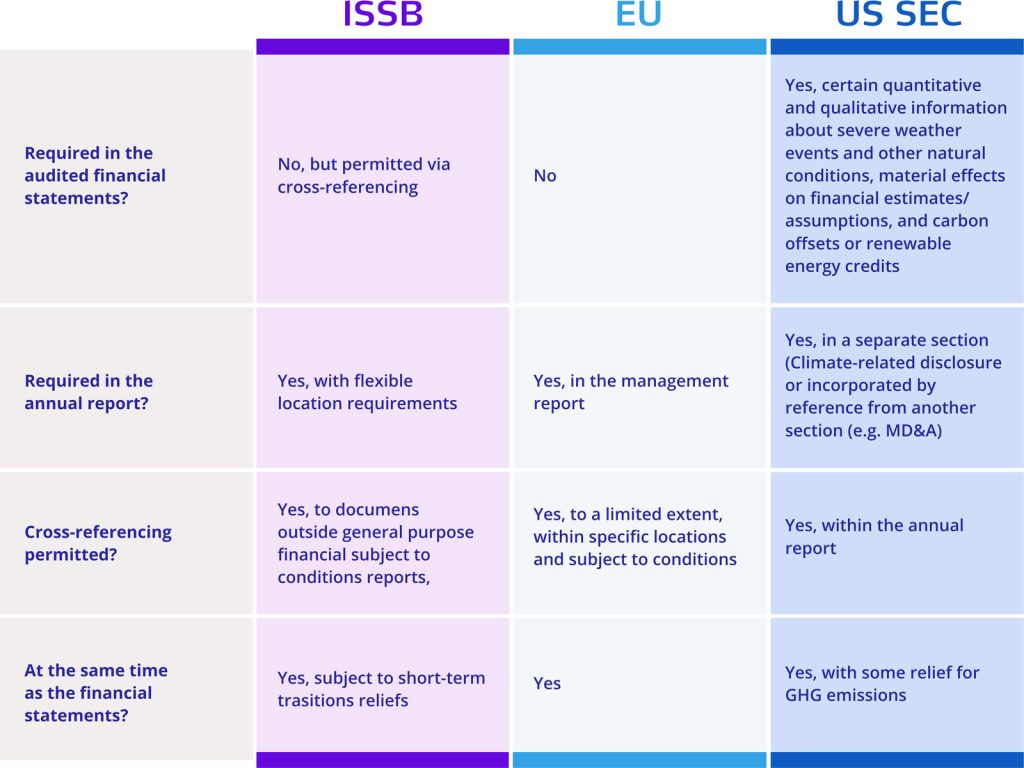

Sustainability reporting is developing quickly, with new requirements from the ISSB, EU, and US SEC, but where and when will ESG information be disclosed across the board?

Comparing sustainability reporting requirements. Report by KPMG. March 2024